2022-04-01

Rising Lithium Battery Raw Material Costs: How Can Manufacturers Further Reduce Expenses?

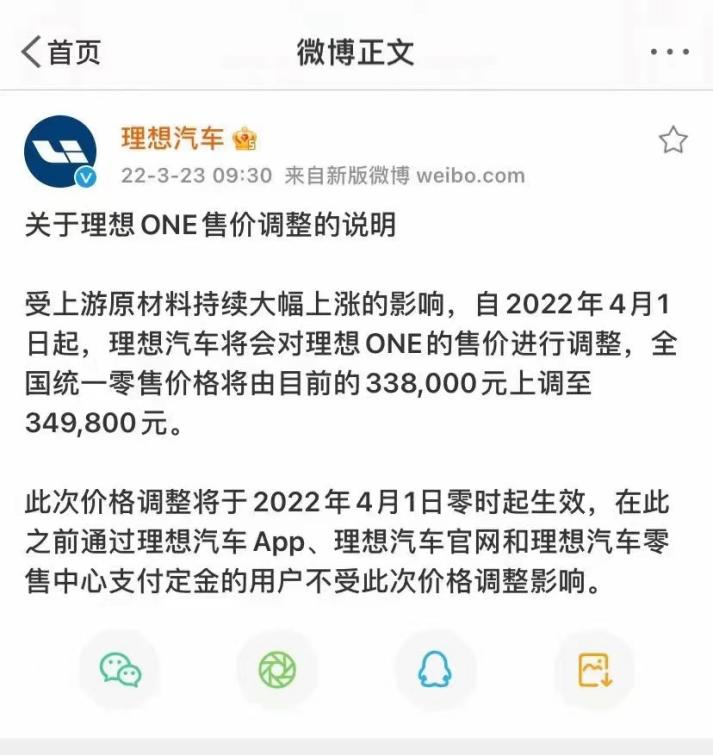

Due to the surge in raw material prices for lithium-ion power batteries, since March 2022 nearly 20 domestic new energy vehicle brands and around 40 major models have announced price increases, some with multiple increases this year. On March 20 Li Auto (Li Xiang) still resisted price increases but announced a price raise on its official Weibo account on March 23.

How much have raw material prices risen?

As a major cost component of new energy vehicles, prices for battery-grade cobalt, lithium, and nickel have surged. Currently, battery-grade cobalt is quoted at 568,500 CNY/ton, nearly three times higher than early 2021; lithium carbonate is 504,000 CNY/ton, up 73.8% year-to-date and 479.3% year-over-year.

What is driving lithium battery price increases?

1. Rapid growth in demand for power lithium batteries.

Since 2017, fast-growing EV sales have driven battery installation volumes. As EV adoption increases and manufacturers compete for market share, overall demand has risen sharply.

2. Tight supply of mined raw materials leading to shortages.

Major lithium mines are located in Chile, Australia, Argentina and Bolivia; cobalt is concentrated in the Democratic Republic of Congo, Indonesia, Australia; nickel in Australia, Russia, etc. COVID-19 disruptions and concentration among leading miners have also pushed prices higher.

High battery scrap rate is another major cost driver

Besides raw material costs, scrap caused by overlapping feeding during cell assembly is a significant cost. Producing a lithium battery cell requires around 60–140 stacking steps for electrodes, and a single duplicate feed can scrap the cell; production tolerances are extremely strict.

Last year,

during a site visit to a cell manufacturer, Atonm found the defect rate from duplicate stacking reached 2.14%. This not only increases material losses but can also affect delivery schedules.

Because electrode sheets and tabs are light and thin, negative pressure during feeding can cause overlap; even adding vibration steps during feeding often fails to fully prevent overlaps.

Because battery sheet materials are light, small and thin, off-the-shelf Metal Double-Sheet Detectors often fail to meet industry process requirements, causing frequent false positives and negatives.

Atonm is the first domestic company to develop a Lithium Battery-specific Metal Double-Sheet Detector. The MDSC-1000L performs excellently in tab welding and stacking processes and can handle mixed electrode feeding.

You May Be Interested

-

Atonm MDSC-9000T Dual-Channel, Single-Sensor Metal Double-Sheet Detector

2025-12-05

-

Non-Contact “One-to-Four” Double-Sheet Detector 1600S: A New Cost-Reduction and Efficiency Solution for Stamping Lines

2025-11-20

-

Mold damage, production delays? Atonm MDSC-8200T metal double-sheet detector protects automotive stamping lines

2025-10-30

-

Provincial Auto Industry Research Tour | Atonm Engages with the Automotive Supply Chain, Empowering Smart Manufacturing through Sensors

2025-10-11